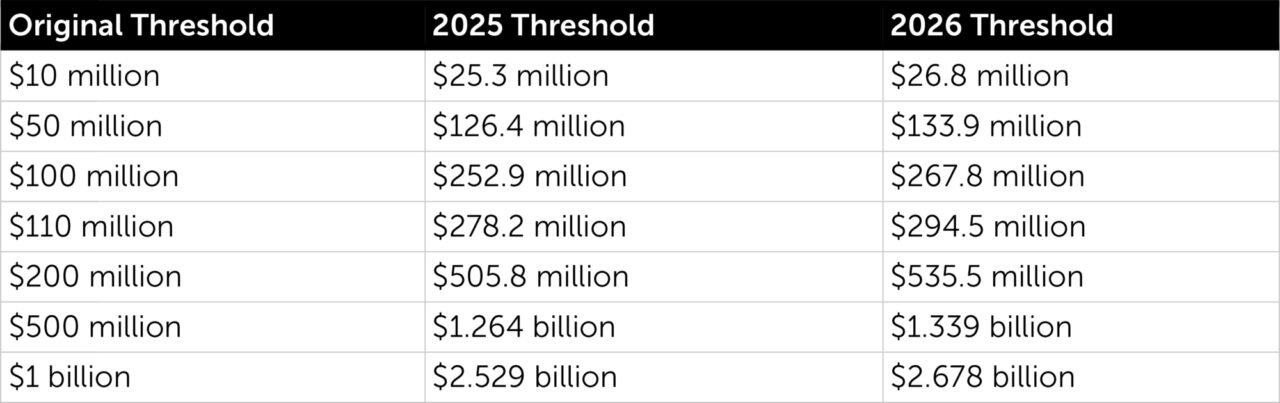

FTC Announces New HSR Thresholds

Client Advisories

Hughes Hubbard & Reed LLP • A New York Limited Liability Partnership

One Battery Park Plaza • New York, New York 10004-1482 • +1 (212) 837-6000

Attorney advertising. This advisory is for informational purposes only and is not intended as legal advice. Prior results do not guarantee a similar outcome. For more information: https://www.hugheshubbard.com/legal-notices.